Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

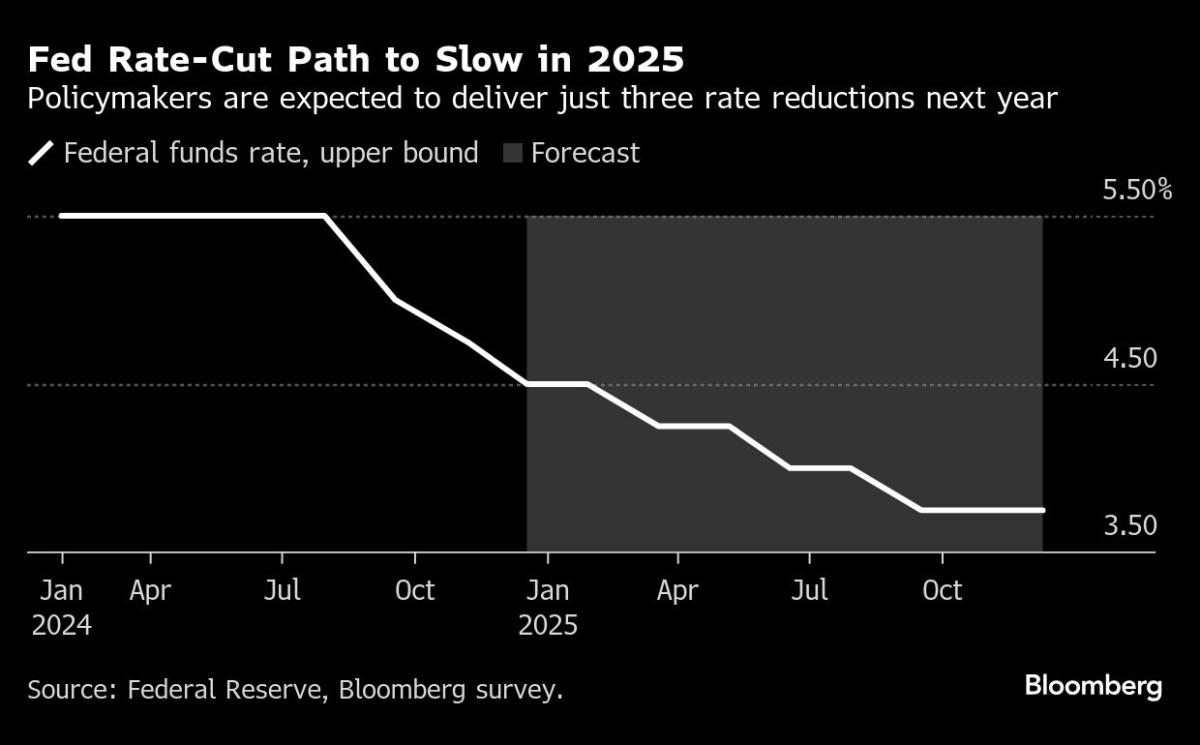

(Bloomberg) — The Federal Reserve rattled U.S. markets on Wednesday, dragging down stocks and sending Treasury yields higher, after predicting interest rate cuts next year. It was the worst loss for the S&P 500 on a decision day since 2001.

Information Read from Bloomberg

The S&P 500 fell below the 6,000 level, suffering its worst session since August. The tech-heavy Nasdaq 100 fell 3.6%, the most in five months. Financial reports for Micron Technology Inc.

Subscribe to the Bloomberg Daybreak podcast on Apple, Spotify or wherever you listen.

The yield on the two-year US Treasury rose 10% to 4.35% and the 10-year rose to a level last seen in May. The Bloomberg rate for the dollar was the highest since November 2022.

While Jerome Powell delivered the much-anticipated interest rate hike after the Federal Open Market Committee meeting, the central bank showed more interest in inflation, including a reduction in how members expect it to end in 2025. The bank will remain cautious as it considers further policy changes and said the Fed is committed to meeting its 2% target.

“We should see some progress in inflation,” Powell said. “This is how we think. It’s a new thing. We walked fast to get here but moving forward we are walking slowly.

The speed of Wednesday’s decline is consistent with the speed with which the Fed returned to its lowest levels. In the latest session, the S&P 500 has risen more than 10% since the FOMC’s decision on July 31, when the central bank abandoned its one-sided risk assessment and said that expanding the labor market has become a priority.

In a briefing on Wednesday, the chairman also said some policymakers are beginning to include in their forecasts the potential impact of the tariffs that President-elect Donald Trump may use. But he said the results of such policies are not clear.

Max Gokhman, senior vice president at Franklin Templeton Investment Solutions, called Powell “a hawk in pigeon’s clothing.”

“While downplaying the current recession while boasting about economic growth, he also said that tariffs will not be dismissed as short-term and that the forecast for the middle of 2025 is important because policies should be restrictive,” he said. he said.

The last time the S&P 500 saw a major loss on the day of the Fed’s decision was on Sept. 17, 2001, when the index fell almost 5%. It fell 12% on March 16, 2020, a day after the Federal Reserve’s emergency weekend meeting on the pandemic.