Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

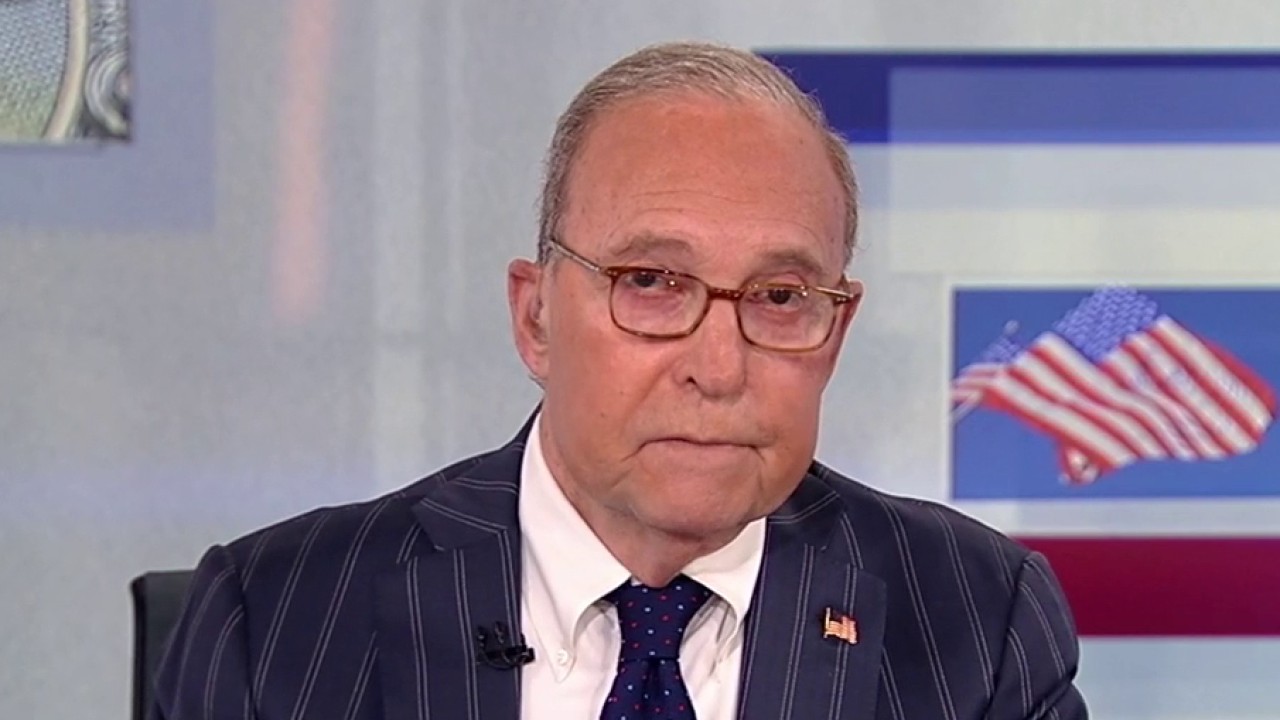

FOX Business host Larry Kudlow says Americans remember how good they were during the Trump years on ‘Kudlow.’

Trump Tax Cuts 2.0 I can’t wait, and that’s the theme of the riff. In the years of President Trump for the first time, the average weekly wage – also known as take-home pay – rose more than 9%.

During the Biden years, take-home pay has fallen by 3.6% over his entire tenure so far.

Another statistic: The median household income in the Trump years rose to $7,700 pre-COVID, adjusted for inflation. Under Joe Biden, the median income rose to just $1,000. Those two numbers, take-home pay and median income, have a lot to do with Trump’s quick victory.

This was kitchen news for many of Trump’s operatives who were of all stripes and deeply embedded in the old coalition of Democrats.

The economy is at the forefront of every election. When the work people are losing money and they cannot afford gas, groceries, electricity, new cars or new houses – race has no role. It’s about the economy, and more and more people remember how good they had it in the Trump years and how hard they were in the Biden-Harris years.

BIDEN MOURNS HUNTER BIDEN’S SON AFTER LEAVING THE OVAL OFFICE

Sen. Rand Paul, R-Ky., discusses President Donald Trump’s plan to stop dumping waste in the federal government on ‘Kudlow.’

Here’s my point: The sooner the president-elect can restore the blue-collar boom, the stronger his political position will be in Congress and around the world. This is why I am concerned that the new administration will not start their legal careers and reduce taxes.

We understand that there will be two reconciliation costs. The first to fight for power, security and boundaries. The deputy will also agree to reduce the tax going to the end of the year. I don’t think the tax cuts should wait, just as I don’t think Mr. Trump thinks the tax cuts will have to wait. They want good take-home pay and lower prices.

I’m in favor of whatever it takes to get 3 million barrels of oil out a day and bring oil down to $2 a gallon.

I’m very much in favor of building a wall to close the border, and if we’re going to transition from Biden to a Trumpian policy of peace through force, we’re going to need a strong and efficient Pentagon, but give up on taxes. being cut into the dust for some future time does not strike me as a good idea, economically or politically.

Why not one big reconciliation bill? Which, until recently, was promoted by House Majority Leader Steve Scalise and others. Cross the boundaries of financial planning to include all the areas discussed earlier.

Remember the Finance Secretary who was appointed by Scott Bessent’s 3-3-3 formula? Three percent or better growth. Reduce the deficit to 3% or less of GDP and add 3 million barrels per day. All the best.

Tax cuts will go a long way in helping us get above 3% growth and controlling the blue, and people should listen to Sen. Mike Crapo, who is expected to lead the Senate Finance Committee next year, who said “the cost of the legislation should be weighed against the current policy, which is based on popular Trumpet the tax reduction will be extended indefinitely.

Mike Crapo said on the show that, according to the Congressional Budget Office, if you let the money go on forever, so it increases every year, no one finds it too small, but, for some reason, if you let it. tax cuts continue forever, they want to know if the interest rate increases – with a fixed number, such as an increase of $ 4 trillion.

That’s nonsense. If continued spending is the current policy, continuing to cut taxes should be the current policy. This is what Sen. Crapo told me a few weeks ago:

SEN. Mike Crapo: And I’ll tell you something interesting, Larry: Under the monetary policy we use, and the scoring system, increasing current spending is not like interest, but increasing current tax (cut) like deficit.

By the way, the same Trump Tax Cuts 1.0 from the 2017 Tax Cuts & Jobs Act will bring a big tax break.

Economist Larry Lindsey reported in a report last summer that corporate taxes alone produced more than 30% more revenue than the CBO predicted in 2016, the year before Trump’s tax cuts, and the top 1% of taxpayers continue to do so. overpaying the entire sector, now up to about 46%, which is a good reason to reduce the tax rate for all people as much as possible.

In addition, the need for a small 1099 tax deduction, I remember that small businesses with LLCs pay individual taxes, and Steve Forbes is right – reducing income tax will not only increase financial income but also productivity and growth, it will also bring interest rate as high as it did before.

Soon the Trump 2.0 Tax Cuts will start moving through Congress, Trump’s working class voters will be happy, and the blue sky will rule. That’s the bone.

This article has been adapted from Larry Kudlow’s opening remarks on Dec. 3, 2024, edition of “Kudlow.”