Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Open the Editor’s Digest for free

Roula Khalaf, Editor of the FT, picks her favorite stories in this week’s newsletter.

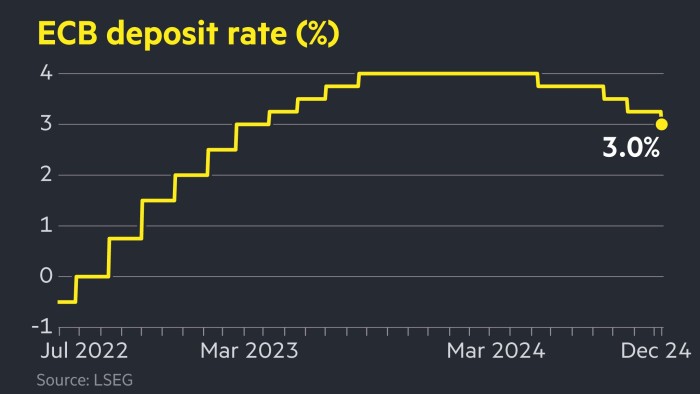

The European Central Bank cut interest rates by a quarter to 3 percent, as it toned down its hawkish language and warned that growth would be weaker than it had forecast.

The ECB’s cut – its fourth cut in lending rates since June – took the central bank’s interest rate to its lowest level since March 2023.

It came as the ECB warned that Eurozone economy it will grow by just 1.1 percent in 2025, down from September’s 1.3 percent.

The ECB abandoned its commitment to “maintain policy measures in the long term” to reduce interest rates in line with its 2 percent target. Instead it emphasized that the “consequences of a failed monetary policy” would “fade out” over time.

The euro was unchanged at $1.048 in trading shortly after the break.

Investors expect that The price of the ECB will cut rates more than the US Federal Reserve next year, as growth in the Eurozone is expected to lag behind the US.

The region’s richest economy is under threat from President Donald Trump’s threat to impose tariffs of up to 20 percent on all US goods.

Traders expect the ECB to hold another nine rate hikes by next September, which would take the rate to 1.75%. Expectations did not change after Thursday’s election.

Swaps markets are bracing for a 0.75 percent rate cut from the US Federal Reserve at the same time, which would put the target rate at between 3.75 and 4 percent.

Earlier in the day, the Swiss National Bank cut its benchmark rate by 0.5 percent, a bigger cut than expected.

This is a growing issue